Top Tax Benefits of Investment Property in Australia

If you’re looking to grow your wealth through property investment, you may already know that the Australian tax system offers some significant benefits for property investors. By using tax-saving strategies, you can reduce your overall tax liability, allowing you to retain more of your hard-earned money and grow your wealth faster.

In this post, we’ll explore the most common tax benefits available to Australian property investors, and how Compass’s expertise can help you take full advantage of them. For those interested in learning more about how property investing can lead to financial freedom, check out our guide on The Path to Financial Freedom Through Property Investing.

Key Tax Benefits for Property Investors In Australia

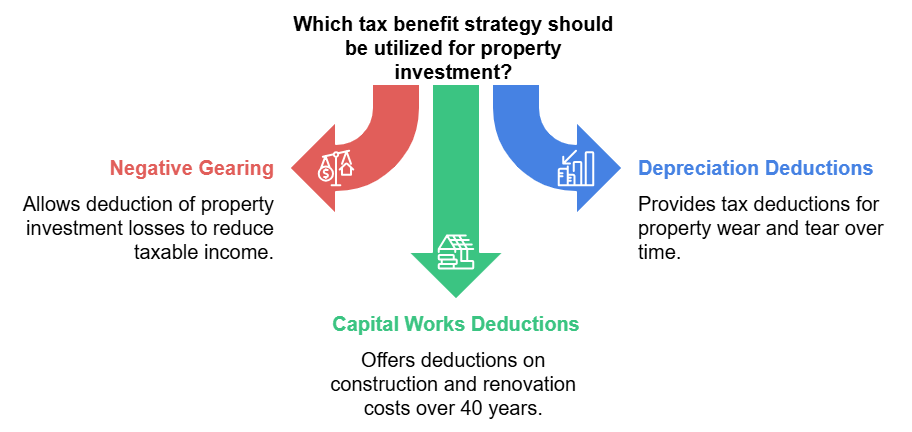

1. Negative Gearing

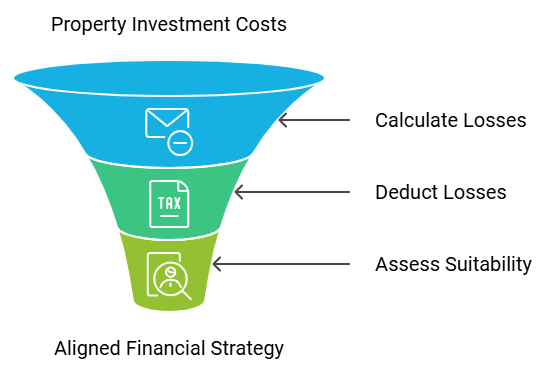

Negative gearing allows investors to claim a deduction for losses made on an investment property. If the costs of owning your property (e.g., interest on your loan, maintenance costs, insurance) exceed the rental income it generates, you can deduct this loss from your other income.

Example: If your rental property incurs a loss of $10,000 in a year, you can use this amount to reduce your taxable income, lowering your overall tax bill. For more details, refer to the Australian Tax Office’s guide on rental property deductions.

Compass Insight: Negative gearing isn’t suitable for everyone. We help our clients understand if this strategy aligns with their financial goals and how it impacts their overall investment plan.

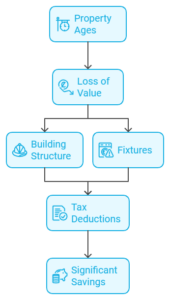

2. Depreciation Deductions

As a property ages, certain aspects of it lose value, which can be written off as a tax deduction. These depreciation deductions cover the “wear and tear” on both the building structure and any fixtures, such as carpets and appliances.

Example: Through depreciation, you might be able to claim deductions worth thousands of dollars each year, especially with newer properties that have higher depreciation rates.

Compass Insight: We recommend a professional quantity surveyor to ensure you’re claiming the maximum depreciation deductions. Many clients are unaware of how much they could save through depreciation alone!

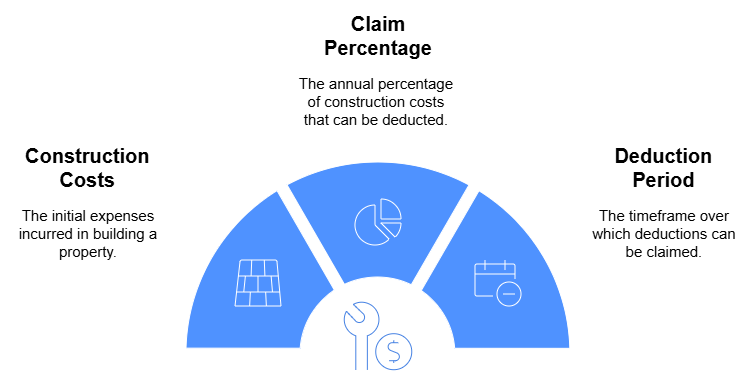

3. Capital Works Deductions

Capital works deductions relate to the construction costs of a building. For properties built after 1987, investors can claim a percentage of the property’s construction costs over 40 years. This deduction is also applicable to certain renovations or improvements made to the property.

Example: If your property qualifies, you could claim 2.5% of the construction cost each year, providing a substantial reduction in taxable income over time.

Combining Tax Benefits for Maximum Savings

The key to maximizing your tax savings is to combine these strategies effectively. By using negative gearing, depreciation deductions, and capital works deductions together, you can significantly reduce your tax liability while building wealth.

For a comprehensive guide on how property investment can help you achieve financial freedom, be sure to read our blog on The Path to Financial Freedom Through Property Investing.

Why Compass?

At Compass Property Investing, we don’t just help you find the right property; we help you make the most of your investment with expert tax-saving strategies. Here’s what sets us apart:

- In-Depth Tax Knowledge: We guide you through complex tax benefits to ensure you’re maximizing your savings.

- Conservative Approach: Our focus is on sustainable, long-term growth, making sure you benefit from tax deductions without over-leveraging.

- Personalized Strategy: Our advisors work with you to develop a plan that aligns with your financial goals and risk tolerance.

Start Maximizing Your Wealth Today

Want to see how property investment could reduce your tax bill and grow your wealth? Schedule a free consultation with Compass and we’ll walk you through the best tax-saving strategies tailored to your unique situation. Contact us to schedule your free consultation.