The Path to Financial Freedom Through Property Investing

Achieving financial freedom may sound like a dream, but it’s an attainable goal—especially if you leverage property investment effectively. With the right strategies, property investing can provide a stable income stream, grow your wealth over time, and even help you pay off your mortgage faster.

At Compass Property Investing, we believe that everyone deserves the chance to achieve financial independence, and we’re here to show you how property investment can be your key to getting there.

In this guide, we’ll break down the basics of building a wealth-generating property portfolio and outline how Compass’s conservative, proven strategies can help you get on the path to financial freedom.

Why Property Investing?

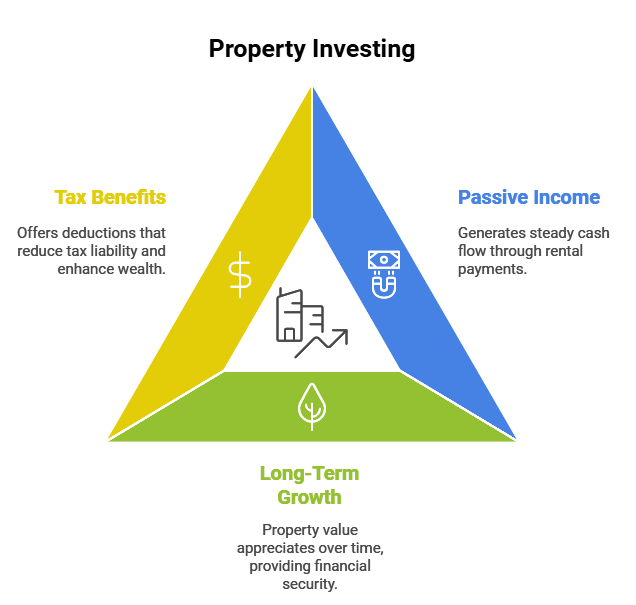

For many people, property investing offers a combination of income stability, appreciation potential, and tax benefits that few other investments can match. Here’s why:

- Passive Income: When you invest in property, you can generate passive income through rental payments, creating a steady cash flow that can cover expenses and even build savings.

- Long-Term Growth: Unlike many investments that are subject to market volatility, real estate generally appreciates in value over time. This means your property not only earns rental income but can also increase in value.

- Tax Benefits: Property investors in Australia can benefit from tax deductions through mechanisms like negative gearing and depreciation schedules. This can significantly reduce your tax liability and help grow your wealth faster. Explore tax deductions for property investors.

Steps to Achieve Financial Freedom with Property Investing

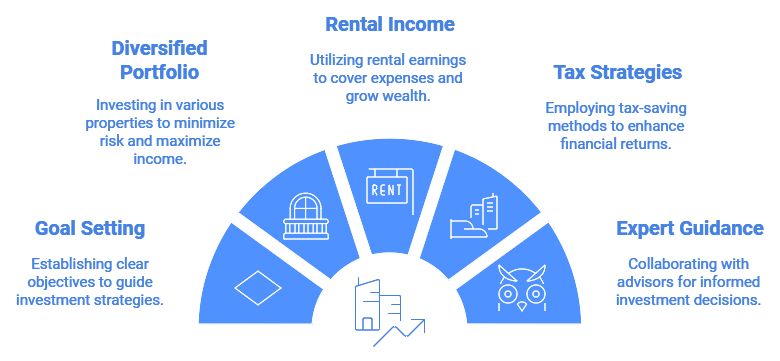

- Set Clear Financial Goals

Financial freedom means different things to different people. Some want to retire early, while others aim to supplement their income or pay off their mortgage faster. Start by defining what financial freedom looks like for you:

- How much passive income do you need each month?

- What’s your ideal timeline for reaching financial independence?

- What level of risk are you comfortable with?

Having clear goals will help you create a focused investment plan tailored to your unique needs.

- Build a Diversified Property Portfolio

A single property can be a great start, but achieving financial independence often requires a diversified portfolio. By investing in multiple properties across different locations and property types, you can reduce risks and increase your potential income.

Compass Tip: Our approach emphasizes low-risk diversification, focusing on areas with consistent growth potential and high rental demand. This way, you can build a resilient portfolio that generates reliable income.

- Use Rental Income to Grow Your Wealth

One of the biggest advantages of property investing is the ability to earn rental income. With a well-chosen property, your rental income can cover mortgage payments and other expenses, allowing you to grow your wealth without having to dig into your personal savings.

Real-life Example: Many Compass clients use their rental income to accelerate mortgage repayments on their personal homes, reducing their loan term significantly.

- Take Advantage of Tax-Saving Strategies

Australian property investors have access to tax-saving tools like negative gearing and depreciation schedules. Negative gearing allows you to claim a deduction on any losses made on your investment property, reducing your tax bill. Meanwhile, depreciation deductions can offset some of the wear and tear on the property.

Compass Tip: We guide our clients through these strategies, helping them maximize their tax savings while keeping their finances in check. Top Tax Benefits of Property Investment in Australia.

- Work with Experienced Advisors

Property investment can be complicated, especially if you’re new to it. Working with trusted experts like Compass ensures that you’re making informed, conservative choices. We’ve helped thousands of clients achieve financial freedom, using strategies backed by over 18 years of industry experience.

Compass’s Proven Approach to Financial Freedom

At Compass Property Investing, our conservative, client-centric approach focuses on achieving sustainable growth rather than risky gains. Our advisors work with you to create a personalized strategy, guiding you through every step of your investment journey.

Why Choose Compass?

- Commission-Free Advice: Our priority is you, not commissions. We provide honest, pressure-free guidance.

- Proven Strategies: With 18 years of experience, we offer investment strategies that have helped over 2000 clients reach their financial goals.

Focus on Financial Freedom: We’re here to help you build wealth, reduce taxes, and pay off your mortgage faster.

Take the First Step Toward Financial Freedom Today!

Ready to take control of your financial future? Schedule a free consultation with Compass to discuss your goals, explore options, and start your journey to financial freedom.